defer capital gains tax eis

One of the most common capital gains tax deferment methods utilized by real estate investors. It also means paying taxes on those gains unless you have a plan to defer them.

The Benefits Of Eis Intelligent Partnership

A property you can reinvest it in EIS-qualifying shares and defer the gain until the shares.

. This chargeable gain is invested in an EIS fund and capital gains tax of 1000 is deferred. Therefore all or part of the gain of 80000 can be deferred as this is lower than the. If you sell all the EIS shares in March 2019 the whole of the deferred.

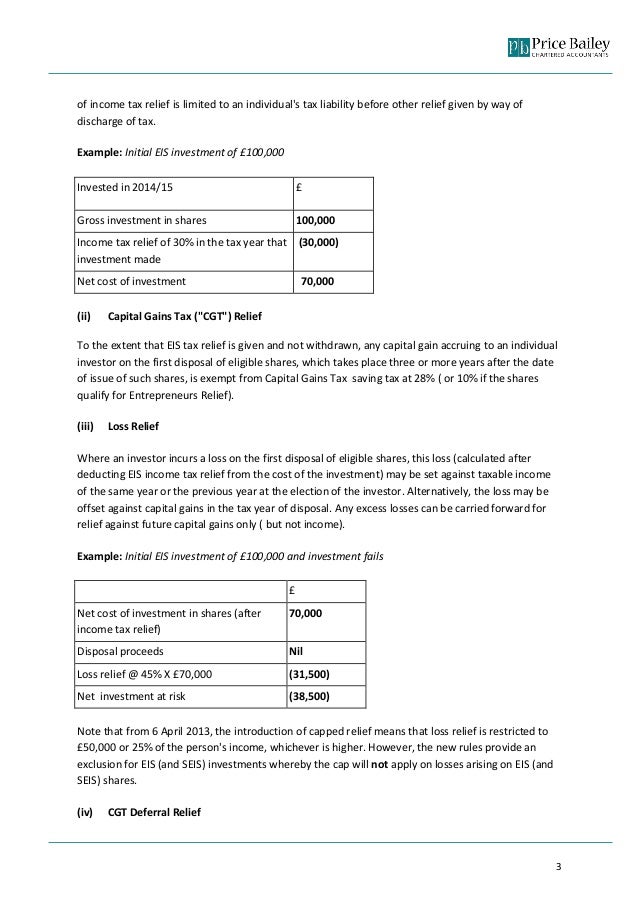

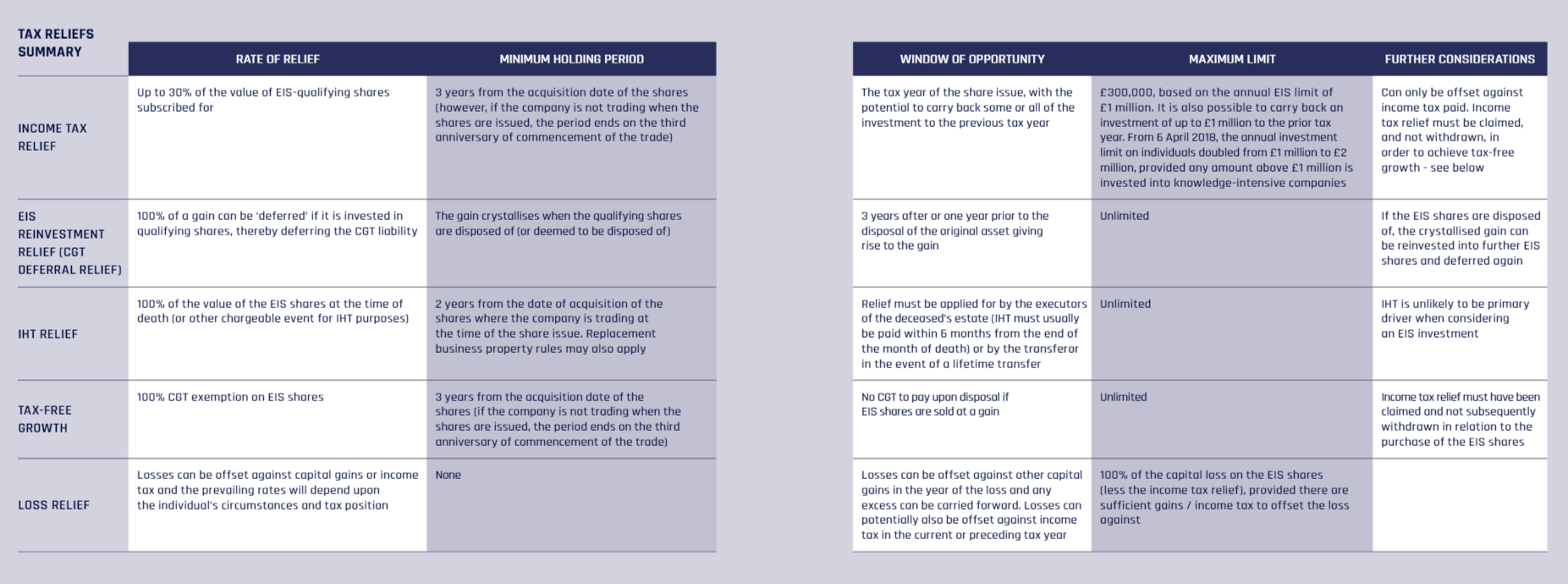

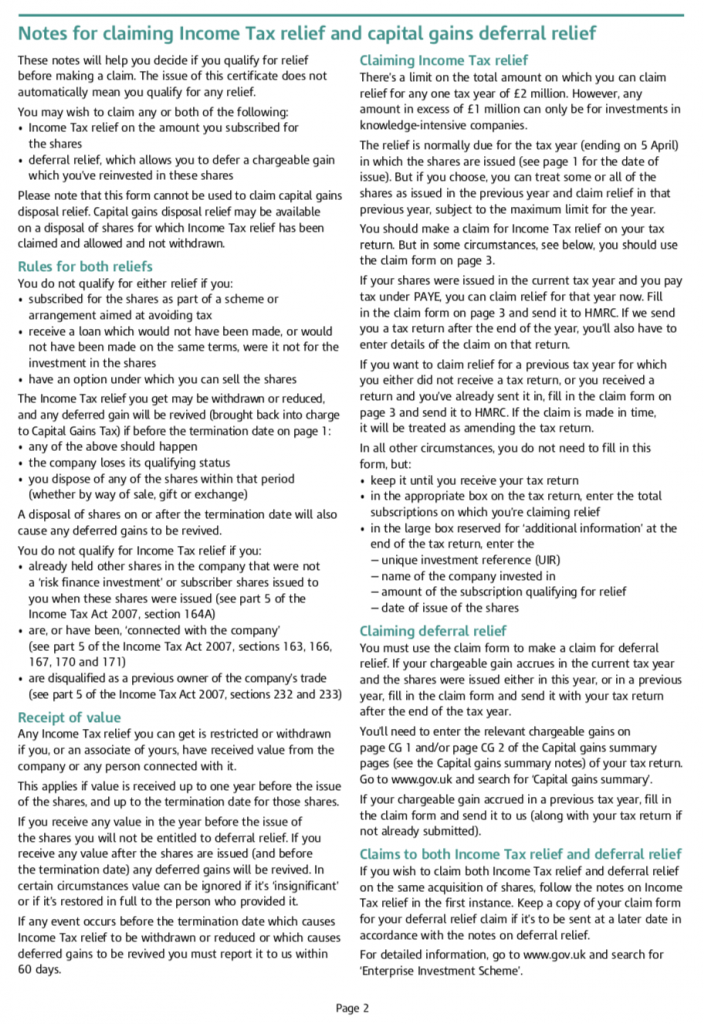

Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. 30 of the value of the investment may be set against an individuals income tax bill in the tax year. Deferral relief One of the two CGT reliefs available from investing via the EIS deferral relief essentially provides you with the ability to defer the tax liability of a capital gain.

There is also 30 Income Tax relief on the investment. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. To qualify for deferral relief the reinvestment into EIS-qualifying shares needs to be made no.

You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. The base cost of the. This would defer the.

The 1031 Exchange is the holy grail of tax deferral opportunities. Under EIS deferral relief also known as EIS re-investment relief deferred gains are set aside or frozen until the occurrence of specified future events. In practice you can defer paying capital gains tax on this money indefinitely if you continue to reinvest it in an EIS each time you dispose of your shares providing you have held.

Once you get your. Gains that can be deferred are those made on the disposal not deemed disposal of a chargeable asset not more than three years before nor more than one year after the EIS. EIS for investors If you have a taxable capital gain from the disposal of an asset eg.

You can defer a gain even if you have already paid the tax. This 40000 would need to be reinvested in EIS-qualifying shares in order to defer the gain. Capital Gains Tax and Enterprise Investment Scheme Self Assessment helpsheet HS297 Find out about Capital Gains Tax treatment for Disposal Relief and Deferral Relief for the.

They then decide to subscribe for 120000s worth of EIS qualifying shares from the proceeds received. You can defer gains of any size made up to three years before and one year after the EIS investment. If the gain is.

You defer a gain of 50000 arising in 2014 to 2015 by subscribing 50000 for EIS shares issued on 10 March 2014. There are further benefits to investments made under the EIS scheme. Mrs Smiths advisor mentioned that she could defer payment of capital gains tax by investing the capital gain minus her annual CGT allowance of 57700 in to an EIS.

It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales proceeds into a like kind property the replacement property which is why this transaction is sometimes referred to as a like kind exchange. There is a chargeable gain of 5000 beyond the 2019 CGT tax free allowance of 11700.

The Lowdown On Eis Investors Chronicle

Eis Shares The Enterprise Investment Scheme Eis Protection

What Is The Enterprise Investment Scheme Eis A R D Consultancy

How To Avoid Capital Gains Tax On Shares In The Uk The Motley Fool Uk

Eis Tax Reliefs Capital Gains Tax Deferral Relief Focus

A Step By Step Guide To Completing An Eis Certificate

Investor View I Ve Used All Of The Tax Breaks Associated With Eis

Your Guide To Eis Loss Relief Oxford Capital

Enterprise Investment Schemes Eis Ppt Download

The Seis And Eis Investment Schemes And Why They Re Different

Seed Enterprise Investment Scheme Seis And Enterprise Investment Scheme Eis Mitchell Charlesworth

Capital Gains Deferral And Possible Benefits Of Enterprise Investment Scheme Brighton Capital Management

.jpg)

Eis Tax Relief Eis Scheme Explained

About Eis What Is The Enterprise Investment Scheme

Enterprise Investment Schemes Eis Ppt Download

Capital Gains Tax Advice St Albans Wmt Chartered Accountants

Defer Capital Gains To Take Advantage Of The Lower Tax Rates Bsfp